Here's the biggest thing I learned from my time with Lending Club: don't invest in new loans.

Why? Even though you've looked at their credit history and read why they needed the loan, checked to make sure their income is verified and asked questions about their monthly obligations, there is still one thing you don't know: Will they repay?

Luckily, Lending Club has a way to sidestep this: the trading platform.

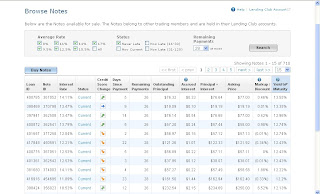

Run by FolioFN, this is where Lending Clubs notes can be bought and sold, and it provides filters that let you find the loans you need.

After I got to "Browse Notes" on the platform, here is what I do:

1. For "Status", click the checkbox for "Never Late". Unclick the others. You don't want someone who pays their loans late. Ever.

2. Put the "Remaining Payments" at 28. This means that they have been paying on time for eight months straight. This is more of a "gut" number. If you want more saftey, pick a lower number (which means they've paid on time longer). Vice versa if you want more risk.

3. Click "Search".

4. The right hand column is "Yield to Maturity". Click on it twice. This will order them from greatest yield to least.

5. I look for loans that were originally $25 (by now they're around $20) and that have yields higher than 11%. Buy them.

6. Although I've been tempted to buy loans with high returns that were above $25, I have stayed away. Why? You can absorb a $25 default. A $200 default will kill your bottom line. Buying a large number of small loans will spread your risk more than a small number of large loans.

7. I recommend checking the platform once a day rather than trying to invest everything at once. One day all the good loans available might be at 10% and the next day you'll find good ones at 13%. I recommend buying $100-200 a day until you're fully invested.

No comments:

Post a Comment