_

The risk of using Lending Club is debtors that don't pay. So far, I've only had three loans fall behind, and so far there were three different outcomes.

1. Worth noting, though, is that

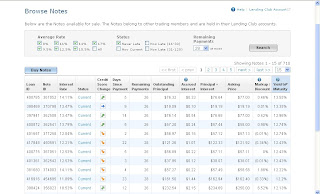

the only loans that were late were those that I invested in as new loans. I have yet to have a loan that I bought on the trading platform go late, and that's because I only bought loans from debtors who had been paying on time for eight months or more.

2. The first was when I wasn't regularly checking the account, and when I caught it it was already more than

a month late. The debtor had made only one payment before he stopped paying. I tried to sell the loan, but no one would buy it, even at 2/3 off the price.

I believed I was going to loose the money. The something interesting happened. The loan was referred to debt collection and then

the whole thing was paid off. I don't know if he secured another loan from elsewhere or put it on a credit card, but either way

I got my money back.3. The second one happened while I was checking on the first. I noticed that its status was "In Grace Period", which meant that the loan was late, but less than two weeks late. After "Grace Period", Lending Club marks it as "Late", which will make it hard to sell (I assume most people, like me, do not buy late loans). So I put it on the market and steeply discounted it at $20, a 20% discount. It was purchased a day later.

I lost almost $5, but it was better than loosing $25.

4. The third one is currently late, but I'm waiting and seeing. It was one of the loans I picked up when I was still bidding on new loans instead of buying them on the trading platform. It was a $75 loan that had been paid for 6 months before the debtor fell behind. I saw that it was "In Grace Period" and put it up for sale, again at a $5 discount. Possibly because it wasn't a steep enough discount relative to the worth of the loan, no one bought it. I saw that the debtor had been communicating with Lending Club and had been put on a payment plan by them.

I now had a choice: discount deep enough to sell and loose that money, or hold onto the loan and hope the debtor caught back up on his payments.

Since he had paid on time for six months, I decided to take a gamble and see if he would bring his account current. If he does, I am going to sell the loan. With the listing at "current", it hopefully should sell with only a minimal loss. His next payment is due on 3/10/10. I will post after to notify everyone if he paid.

Lessons:1. Don't invest in new loans.2. Check the status of loans weekly to make sure all are current.3. If a loan is in Grace Period, immediately try to sell it before it becomes "Late".4. Keep loans to $25, so that you don't have to loose too much money trying to sell them before they become late.Update: Someone bought the $75 loan off me. It was still discounted at $5 off, but considering I'd already gotten $4 in interest payments off of it, my loss was $1.

I'd like to also point out that since I've made hundreds of dollars in interest from Lending Club, loosing $6 is just the cost of doing business. The trick is to stay on top of it so that you don't end up holding a bum loan and having it blow a hole in your bottom line.

Chargepod Base Unit

Chargepod Base Unit